Paypal is now offering a buy now pay later service in Australia. Check out how it works and how it compares to Afterpay.

We all know about Afterpay and Paypal's little known PayPal Pay in 4 is now available to PayPal Australian customers. Like Afterpay and similar services like Zip, it allows customers to pay off purchases in 4 equal fortnightly instalments with no late fees if the final payment is missed.

What is PayPal Pay in 4?

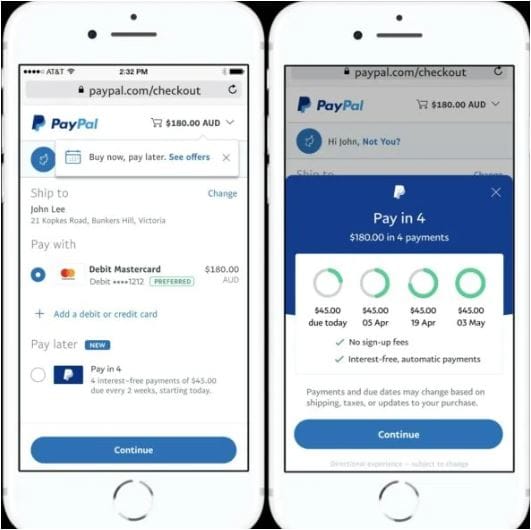

A buy now pay it later service without paying anything upfront - pay over four equal interest-free instalments.

Image www.paypal.com

How does PayPal Pay in 4 work?

Paypal Pay in 4 allows you split purchases from $30 to $1500 over four equal interest free payments. The first payment is payable when you first purchase and the remainder are drawn every 2 weeks. Payments are deducted from your nominated Paypal account.

Let's say you purchase an item for $1000, you will pay $250 upfront and then make $250 repayments each fortnight. The purchase is paid in six weeks. Afterpay works the same.

Use the standard Paypal button on the Dreamy Kidz website and Pay in 4 will appear at checkout. Easy!

How much does PayPal Pay in 4 cost?

Late fees are waived if you miss a payment

The only fee will be any currency conversation fees on international purchases.

How does PayPal Pay in 4 differ to Afterpay?

The main difference is Afterpay charges a $10 late fee if the final payment is 7 days overdue.

So, if you make a purchase and pay it off on time both Afterpay and PayPal Pay in 4 will cost you nothing. Afterpay charges a late fee if you miss a repayment.

Check out Paypal to learn more.